NIST SP 800-63A IAL3 verification involves an intensive verification process designed to prevent impersonation attacks and ensure security against impostor schemes. This involves identity proofing as well as physical biometric comparison for verification strength rating of Strong or Superior.

TrustSwiftly’s seamless hardware-locked capture of Superior evidence ensures compliance with IAL3, while protecting from vulnerabilities like spoofing.

IAL3 compliant solution

The NIST 800-63A IAL3 Digital Identity Guidelines form the cornerstone of modern security, emphasizing comprehensive IAL3 identity proofing and secure federated identities. They advocate for hardware-backed authenticators such as FIDO Passkeys to prevent advanced phishing attacks and support advanced phishing resistance measures. TrustSwiftly utilizes an on-demand verification process with remote yet supervised supervision that combines document authentication, biometric comparisons with liveness detection and liveness detection to help organizations meet NIST requirements, ultimately reducing cyber liability insurance premiums as well as operational costs by decreasing password reset requests.

A CSP must collect Personal Identify Information in order to fulfill the identity resolution, validation and verification that is required at an IAL3 verification tier. This may involve collecting facial images with liveness detection technology as part of identity proofing or fraud mitigation activities. PII cannot be used for other purposes other than proofing identity proofing related fraud mitigation efforts; any CSP that uses automated or artificial means to match individual faces against ID images must demonstrate this isn’t taking place.

IAL3 guidelines

IAL3 guidelines help organizations increase the level of assurance required for online transactions. As the highest identity assurance level, this requires a verification agent to assess individuals in person or remotely using evidence such as government-issued documents validated against authoritative sources; biometric comparison is also performed to reduce impersonation and fraud.

In order to meet IAL3 standards, verification processes must be carried out either onsite with an agent or remotely using superior document evidence that includes both the relying party (RP) and verified attributes of individuals, as this ensures that an assertion of an alias or pseudonym by an RP is founded in reality rather than mere appearance.

IAL3 guidelines have been specifically created to mitigate highly scalable attacks on verification processes and provide consumers with a safer online experience. CSPs can tailor digital processes to modern usability expectations while still meeting security goals while protecting privacy. IAL3 makes an ideal choice for high-stakes online transactions involving sensitive healthcare services or personal data that require trust, such as those using it with online banks or services like eBay or PayPal.

Document authentication

Document authentication is a crucial element of IAL3 verification, providing a high level of assurance that claimed digital identities match real-world evidence of identity. It combines direct observation during identity proofing sessions, document validation against authoritative sources and biometric comparison with claimed digital identities to reduce impersonation and fraud while providing strong protection from SIM swaps and MFA bypasses by securely linking biometrics with digital identities.

Verification for the IAL3 can take place either directly or remotely; PII collection should only be undertaken to the minimum necessary for identification resolution and validation. A representative (RP) should only ask for attributes which directly pertain to a claimant and can help verify or validate their identity.

TrustSwiftly’s IAL3 certified passwordless authentication and identity verification solution assists organizations in meeting IAL3 guidelines, strengthening authentication journeys with chat, video, facial recognition with liveness detection and document authentication. This reduces cyber liability insurance costs as well as operational expenses by decreasing password reset requests – in compliance with FedRAMP requirements as it offers several remote NIST IAL3 verification methods.

Biometric verification

Biometric verification is an efficient IAL3 compliant solution that can help businesses avoid costly fraud, reduce cyber liability and meet regulatory compliance. This technology measures unique biological characteristics that are difficult to falsify – such as fingerprints, facial features and iris scans – making the use of biometrics invaluable in protecting businesses against costly fraud, reducing cyber liability and meeting regulatory compliance. Biometrics may also be used to measure behavioral patterns like gait recognition voice recognition handwriting analysis etc.

NIST has issued identity guidelines known as IAL3 verification that are designed to strengthen security by verifying claimed identities with real identities, thus helping reduce stand-in fraud or other forms of fraudulent activity. IAL3 requires high levels of verification and binding with an authenticator which assists in combatting these types of fraudulent activities.

To qualify for IAL3, an individual must present government documents verified by authoritative sources, provide live biometric verification such as facial image captures with liveness detection (either in-person or remotely) and provide live biometric verification using certified personnel; additionally IAL3 verification should include a process to resolve enrollments or duplicates.

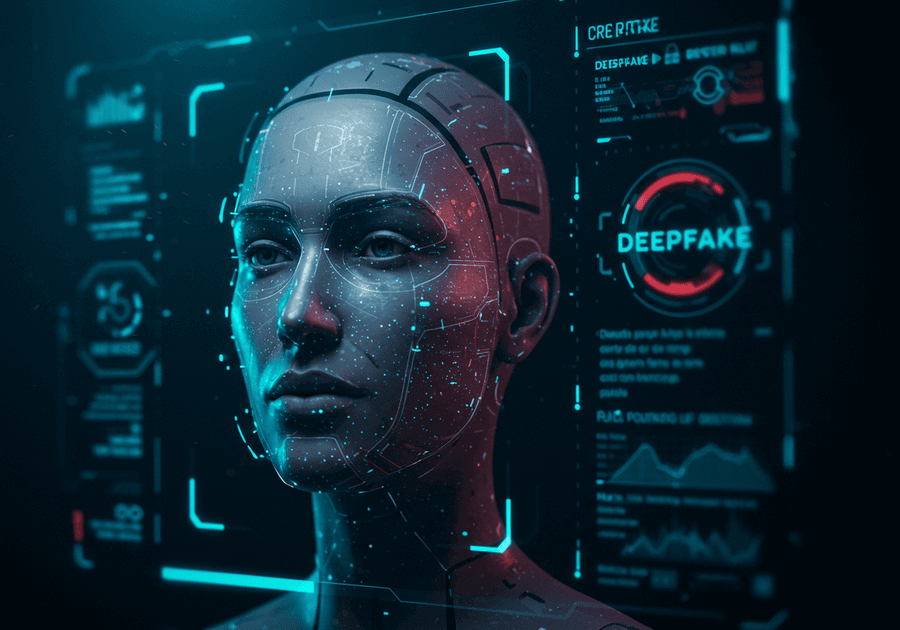

In 2026, the rise of sophisticated AI-driven impersonation has made IAL3 identity proofing the essential benchmark for high-security digital environments. As the most stringent level of NIST identity assurance, IAL3 is reserved for scenarios where the risk of unauthorized access carries catastrophic consequences. To meet this standard, organizations must move beyond automated scans and adopt a process that requires superior evidence and a supervised interaction. Trustswiftly.com solves this challenge by providing a robust, remote-ready framework that eliminates the need for physical travel while maintaining the highest integrity of the “human-in-the-loop” requirement.

The trustswiftly.com platform bridges the gap between digital convenience and government-grade security. By integrating NFC-enabled document verification with live, operator-monitored sessions, TrustSwiftly ensures that the identity binding is cryptographically and biometrically sound. This IAL3 identity proofing workflow is specifically designed to detect and block advanced threats, such as real-time deepfake injections and sophisticated document tampering.

For enterprises seeking to fortify their zero-trust architecture or achieve FedRAMP compliance, trustswiftly.com offers a scalable, transparent, and audit-ready solution that transforms complex identity verification into a seamless, trusted experience for both the administrator and the end user.